Fund Manager's Report

Fund Managers' Report As At 31st December, 2025

In 2025, global trade remained resilient despite US policy changes, with moderate growth, easing inflation, and emerging markets outperforming advanced economies. Disinflation allowed central banks to adjust policies unevenly. Growth was constrained by trade fragmentation, geopolitical risks, and high public debt, but technology investment was positive

The 2025 U.S. economy showed mixed signals, characterized by GDP growth slowing to 1.8%, inflation remaining above 2% due to tariffs, job creation slowing, and unemployment rising to 4.20-4.30%. The Federal Reserve cut rates to 3.50% from 3.75%, new tariffs increased volatility, robust AI investment offset economic headwinds, consumer spending was strong but slowing, the housing market was weak, and new tax legislation increased the federal deficit.

In China, despite overall cooling, key parts of China’s economy remain stable. Advanced equipment and high-tech manufacturing continue to grow, supported by global demand and industrial policies. The external sector contributes through strong exports, partially offsetting U.S. tariffs. Policy support, while measured, provides a backstop, with authorities ready to adjust as needed. Low inflation and easing deflation allow targeted interventions, and initiatives for consumption and SMEs signal Beijing’s commitment to preventing a sharp economic slowdown.

In 2025, the Eurozone economy experienced a moderate recovery, with GDP growth of around 1.3%, supported by resilient household spending and easing inflation toward the ECB’s 2% target. External pressures from trade tensions and geopolitical risks continued to weigh on exports. Wage growth slowed but remained above the rate of inflation, and unemployment continued to decline. Key developments included progress toward completing the banking union and significant fiscal stimulus in major economies, notably Germany.

Global Oil markets in 2025 were characterized by moderate volatility amid a combination of global demand fluctuations, and production adjustments, as investors weighed dented hopes of a Russia-Ukraine peace deal and rising geopolitical tensions in the Middle East around Yemen.

In December, Brent dropped by 3.29% to USD61.68 per barrel from USD62.92 per barrel, as investors considered Middle East concerns and advances in Ukraine peace talks.

On the domestic front, Nigeria's 2025 macroeconomic narrative reflects a cautiously optimistic reset, with GDP and CPI rebasing, improved growth, exchange-rate stability, and firmer inflation anchoring post-structural reform. However, rising fiscal constraints may undermine progress.

In December, the Federal Executive Council approved Nigeria's 2026–2028 Medium-Term Expenditure Framework, projecting NGN34.33trn revenue for 2026 from oil and non-oil sources. Key assumptions include a USD64.85pb oil price, 1.8mn bpd crude oil production, and an NGN1,512.00 exchange rate to guide budget preparation.

Central Bank of Nigeria granted licences to 82 Bureau De Change under new guidelines, effective November 27, 2025, allowing only listed BDCs to conduct foreign exchange transactions. This aims to reform the FX market by reducing arbitrage and curbing unregulated operators, enhancing stability despite potential short-term liquidity tightening.

S&P Global Ratings revised Nigeria's sovereign credit outlook to positive from stable, citing reform efforts and improving macroeconomic indicators, affirming its ratings at ‘B-/B’ and ‘ngBBB+/ngA-2’. The positive outlook reflects improving external, economic, fiscal, and monetary results despite challenges like low GDP per capital, high debt servicing costs, and weak statistical infrastructure.

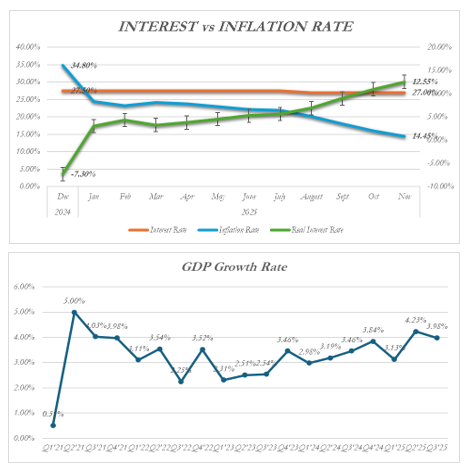

Headline inflation decelerated noticeably in November 2025, easing to 14.45% y/y from 16.05% in October (–160bps). This marks the eighth consecutive month of disinflation, underscoring a sustained moderation in year-on-year price pressures, largely reflecting favorable base effects and the lagged impact of earlier monetary tightening.

According to the National Bureau of Statistics (NBS), Nigeria's economy grew by 3.98% in Q3 '25, an improvement from +3.86% y/y in the corresponding quarter of 2024. However, it was down by 25bpts when compared with 4.23% y/y in Q2-25. Oil sector growth slowed to 5.84% y/y in Q3-25, with production up 11.60% from Q3-24, contributing 3.44% to GDP. The non-oil sector grew 3.91% y/y, contributing 96.56% to GDP. Agriculture, Services, and Industries grew by 3.79%, 4.15%, and 3.77% y/y, contributing 31.21%, 53.02%, and 15.77% to GDP, respectively. Also, supported by a stable macroeconomic environment, easing inflation, and improved FX conditions.

NIGERIAN CAPITAL MARKET REVIEW

At the December Monthly Bond Auction, the Debt Management Office (DMO) offered a total of N460Bn with total allotments at c.N596.47Bn, across the 17.945% FGN AUGUST 2030, and the 17.95% FGN JUNE 2032 papers allotted at marginal rates of 17.20% and 17.30%, respectively

Similarly, the Central Bank of Nigeria (CBN), conducted the last NTB auction of the month by issuing 91-day (Offer: ₦100.0bn; Subscription: ₦100.63bn; Sale: ₦100.01bn), 182-day (Offer: ₦100.0bn; Subscription: ₦22.66bn; Sale: ₦22.07bn), and 364-day (Offer: ₦500.0bn; Subscription: ₦1,385.76bn; Sale: ₦581.99bn) instruments with stop rates of 15.5000%, 15.95000%, and 17.5100%, respectively.

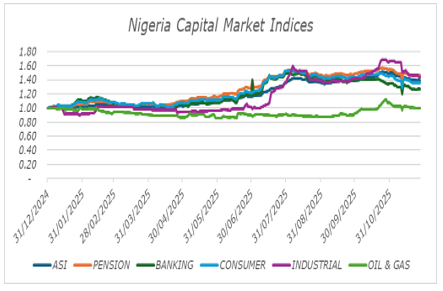

In December, the NGX-ASI grew by 8.43% to 155,613.03 points, and YTD performance reported 51.19% (previously 39.44%), while market capitalization increased by 8.86% to ₦99.376tn. This highlights investor optimism, supported by macroeconomic reforms, stronger corporate earnings, and rising liquidity inflows into equities.

Also, the NGX Pension Broad and NGX-30 indices registered gains of 59.72% and 48.81%, respectively. Commencing the year at 1,826.89 points and 3,811.94 points, they concluded the year at 2,917.84 points and 5,672.72 points, respectively.

Furthermore, other corporate disclosures during the month are as follows: Listing of Chapel Hill Denham Management Limited’s Series 11 Nigeria Infrastructure Debt Fund of 140,100,000 Units of N100.00 each at N109.50 each under the N200 Billion Issuance Program, and Listing of NGX30M6 and NGXPENSIONM6 Futures Contracts on Nigerian Exchange Limited (NGX), among others.

The chart below shows the trend of the NGX ASI and market capitalization:

In December, the naira appreciated by 0.76% m/m to N1,435.76 against the US dollar at the official window, bolstered by the latest FX sales by the Central Bank of Nigeria (CBN) to strengthen the currency market aggregate supply. Also, it appreciated by 0.41% m/m at the parallel market, closing at ₦1,470.00/$1.00.

Meanwhile, Nigeria's foreign exchange reserves grew by 1.97% m/m to close at $45.49 billion as of December 30, 2025. Next year, we expect Naira stability due to elevated oil receipts, strong oil output, and rising non-oil exports, which will boost reserves. However, risks include lower global oil prices, security challenges, and production disruptions.

Find below the key economic indicators for your perusal:

| DEC-24 | MAR-25 | JUN-25 | SEP-25 | DEC-25 | |

|---|---|---|---|---|---|

| Exchange Rate (₦/USD) | |||||

| Official (NAFEM) | 1,538.25 | 1,538.66 | 1,530.00 | 1,475.00 | 1,435.76 |

| Parallel | 1,665.00 | 1,560.00 | 1,565.00 | 1,502.00 | 1,470.00 |

| Monetary Policy Rate (MPR) % | 27.25 | 27.50 | 27.50 | 27.00 | 27.00 |

| Inflation Rate | |||||

| 12-Mth Ave (%) | 31.43 | 29.30 | 26.60 | 23.46 | 23.01 |

| Year-on-Year (%) | 15.44 | 24.23 | 22.22 | 18.02 | 15.15 |

| Foreign Reserve (Billion USD) | 40.89 | 38.31 | 37.21 | 42.33 | 45.49 |

| Crude oil Price in the Int’l Market ($/barrel) | 74.55 | 73.00 | 67.61 | 65.93 | 61.68 |

| GDP Growth Rate (%) | 3.84 | 3.13 | 4.23 | 4.23 | 3.98 |

| NGX-ASI | 102,926.40 | 105,660.64 | 119,978.57 | 142,710.48 | 155,613.03 |

| NGX 30 | 3,811.94 | 3,921.32 | 4,423.04 | 5,211.19 | 5,672.72 |

| NGX PENSION BOARD INDEX | 1,826.89 | 1,890.00 | 2,179.87 | 2,646.28 | 2,917.84 |

| Liquidity Ratio (%) | 30.00 | 30.00 | 30.00 | 30.00 | 30.00 |

| Cash Reserve Ratio (%) | 45.00 | 50.00 | 50.00 | 45.00 | 30.00 |

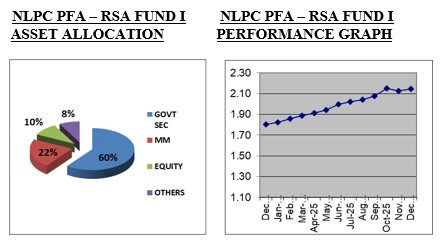

The Asset Allocation and performance of our NLPC PFA – RSA Fund I as at 31st December, 2025 stood as follows:

Quoted Equities 10%, Government Securities 60%, Money Market 22%, Cash & Others 8%. The unit price grew from N2.0737 in September, 2025 to N2.1463 as of 31st December, 2025; translating to a year-to-date and an annualized return of 19.17%.

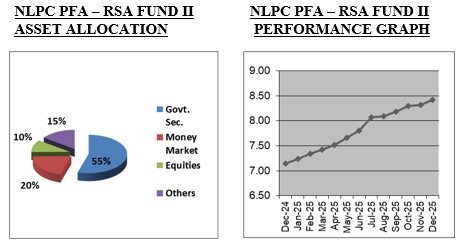

The Asset Allocation and performance of our NLPC PFA – RSA Fund II as at 31st December, 2025 stood as follows:

Quoted Equities 10%, Government Securities 55%, Money Market 20% and Cash & Others 15%. The unit price grew from N8.1784 in September, 2025 to N8.4198 as of 31st December 2025, translating to a year-to-date and an annualized return of 17.79%.

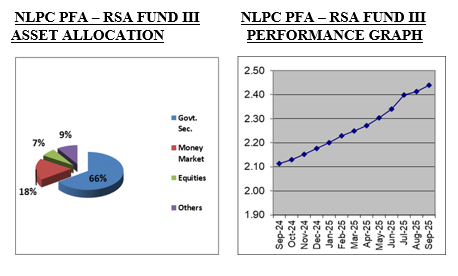

The Asset Allocation and performance of our NLPC PFA – RSA Fund III as at 31st December, 2025 stood as follows:

Quoted Equities 7%, Government Securities 66%, Money Market 18% and Cash & Others 9%. The unit price grew from N2.4383 in September, 2025 to N2.5061 as at 31st December, 2025, translating to a year-to-date and an annualized return of 15.13%.

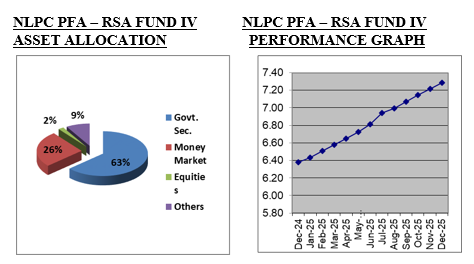

The Asset Allocation and performance of our NLPC PFA – RSA Fund IV as at 31st December, 2025 stood as follows:

Quoted Equities 2%, Government Securities 63%, Money Market 26% and Cash & Others 9%. The unit price grew from N7.0722 in September, 2025 to N7.2886 as at 31st December, 2025 translating to a year-to-date and an annualized return of 14.24%.

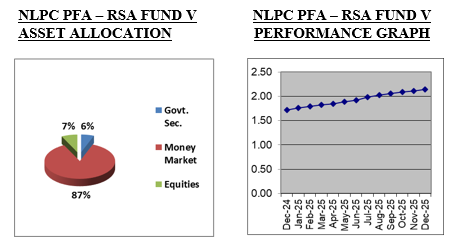

The Asset Allocation and performance of our NLPC PFA – RSA Fund V as at 31st December, 2025 stood as follows:

Quoted Equities 7%, Government Securities 6%, and Money Market 87%. The unit price grew from N2.0537 in September, 2025 to N2.1444 as of 31st December, 2025 translating to a year-to-date and an annualized return of 24.81%.

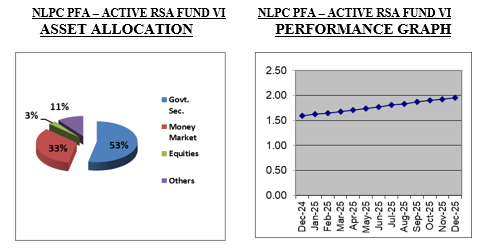

The Asset Allocation and performance of our NLPC PFA – RSA Fund VI - Active as at 31st December, 2025 stood as follows:

Quoted Equities 3%, Government Securities 53%, Money Market 33% and Cash & Others 11%. The unit price grew from N1.8691 in September, 2025 to N1.9526 as of 31st December, 2025 translating to a year-to-date and an annualized return of 22.57%.

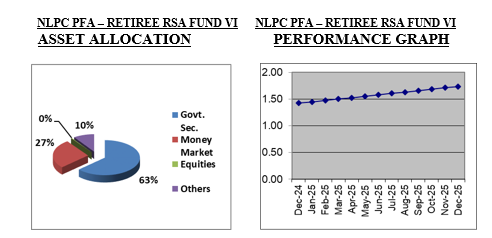

The Asset Allocation and performance of our NLPC PFA – RSA Fund VI - Retiree as at 31st December, 2025 stood as follows:

Quoted Equities 0%, Government Securities 63%, Money Market 27% and Cash & Others 10%. The unit price grew from N1.6616 in September, 2025 to N1.7362 as of 31st December, 2025 translating to a year-to-date and an annualized return of 21.92%.

-

Trade policy uncertainty has become a major source of global instability as sudden shifts in tariffs, subsidies or restrictions fuel volatility. The path forward for the global economy will be determined by how challenges are confronted and opportunities adopted. That said, we expect increasingly divergent growth and risk patterns across regions in 2026.

-

Africa's 2026 economic outlook is cautiously optimistic, with forecasts predicting accelerated growth (around 4.2-4.4%) driven by rebounding commodity prices, policy reforms, strong domestic demand, and a weaker dollar, positioning it as a global growth leader, though challenges like debt, climate shocks, and political instability persist, requiring improved governance and infrastructure to fully unlock its potential.

-

In the domestic market, Nigeria’s inflation is expected to decline going forward, supported by sustained monetary policy tightening, a stable exchange rate, increased capital inflows, and a surplus current account balance. In addition, the relative stability in the price of Premium Motor Spirit (PMS) and improved food supply, supported the pace of disinflation. Thus, we project that interest rates may likely drop further in the coming period.

-

We expect the sentiments across the financial market to be positive in the coming period, especially in the equities market, as more investors take positions in anticipation of impressive Q4 results, and corporate benefits. In view of the expectation that interest rates may go down in the fixed income market, we expect the buying sentiment to be sustained at the mid and long end of the curve, as economic data is looking good, which should prompt MPC to continue its business-friendly expansionary monetary policy going forward.

-

ur strategy in the coming period would be to increase our exposure to fixed-income securities, most especially at the mid and long ends of the yield curve, and scale up our exposure to variable income securities, at the same time, ensuring we balance risk and opportunity while diversifying across different asset classes, not discarding our responsibilities of meeting all financial obligations as and when due..

| NLPC PFA-RSA FUND I ASSET ALLOCATION AS AT 31ST DECEMBER, 2025 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'MLN) | WEIGHT(%) |

| GOVERNMENT SECURITY | 373.75 | 60 |

| MONEY MARKET | 137.82 | 22 |

| EQUITIES | 60.65 | 10 |

| OTHERS | 49.13 | 8 |

| TOTAL | 621.35 | 100 |

| NLPC PFA-RSA FUND II ASSET ALLOCATION AS AT 31ST DECEMBER, 2025 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'BLN) | WEIGHT(%) |

| GOVERNMENT SECURITY | 102.04 | 55 |

| MONEY MARKET | 37.79 | 20 |

| EQUITIES | 19.30 | 10 |

| OTHERS | 27.75 | 15 |

| TOTAL | 186.88 | 100 |

| NLPC PFA-RSA FUND III ASSET ALLOCATION AS AT 31ST DECEMBER, 2025 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'BLN) | WEIGHT(%) |

| GOVERNMENT SECURITY | 124.06 | 66 |

| MONEY MARKET | 34.73 | 18 |

| EQUITIES | 12.87 | 7 |

| OTHERS | 17.82 | 9 |

| TOTAL | 189.48 | 100 |

| NLPC PFA-RSA FUND IV ASSET ALLOCATION AS AT 31ST DECEMBER, 2025 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'BLN) | WEIGHT(%) |

| GOVERNMENT SECURITY | 59.11 | 63 |

| MONEY MARKET | 24.24 | 26 |

| EQUITIES | 1.87 | 2 |

| OTHERS | 8.01 | 9 |

| TOTAL | 93.23 | 100 |

| NLPC PFA-RSA FUND V ASSET ALLOCATION AS AT 31ST DECEMBER, 2025 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'MLN) | WEIGHT(%) |

| GOVERNMENT SECURITIES | 0.56 | 6 |

| MONEY MARKET | 9.32 | 87 |

| EQUITIES | 0.79 | 7 |

| TOTAL | 10.67 | 100 |

| NLPC PFA-RSA FUND VI - ACTIVE ASSET ALLOCATION AS AT 31ST DECEMBER, 2025 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'BN) | WEIGHT(%) |

| GOVERNMENT SECURITY | 8.55 | 53 |

| MONEY MARKET | 5.34 | 33 |

| EQUITIES | 0.47 | 3 |

| OTHERS | 1.67 | 11 |

| TOTAL | 16.03 | 100 |

| NLPC PFA-RSA FUND VI - RETIREE ASSET ALLOCATION AS AT 31ST DECEMBER, 2025 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'BLN) | WEIGHT(%) |

| GOVERNMENT SECURITIES | 2.23 | 63 |

| MONEY MARKET | 0.95 | 27 |

| EQUITIES | 0.01 | 0 |

| OTHERS | 0.34 | 10 |

| TOTAL | 3.53 | 100 |