Fund Manager's Report

Fund Managers' Report As At 31st March, 2024

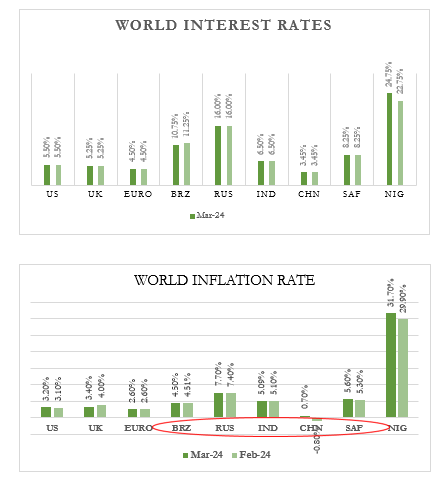

The global economy shows signs of looking better than expected in 2024 as global PMI figures for January and February showed the manufacturing index moving above the median of 50 points for the first time in 16 months, while service sector figures also continued to recover. This picture helps explain why the International Monetary Fund upgraded its global economic growth forecast for 2024 to 3.1%, from 2.9%.

Meanwhile, US economy continues to slow down but the risk of recession is declining given: (i) better-than-expected growth in Q4, 2023; (ii) the manufacturing PMI expanding for 3 straight months; (iii) stronger retail sales in February; and (iv) the firmest consumer sentiment since July 2022. Although overall risk has declined, still-tight monetary policy will likely drag on growth through 2024.

In China, rising profits in the industrial sector reflect ongoing recovery in some parts of the economy but weakness in foreign investment persists despite government efforts to address these problems, including its 24-point action plan. The rising NPLs from property developers and construction companies also indicate that government efforts to improve liquidity and to stimulate demand have been underpowered, and there is an increasing risk that troubles in real estate markets may spill over into the financial sector.

Although the Eurozone avoided a recession in Q4 of 2023, the economy remains weak and at risk of stagnation, and this is reflected in indicators including: (i) softening sentiment; (ii) the elevated cost of funds; and (iii) the weak outlook for overseas markets, which is impacting exports. In addition, the extended Russia-Ukraine war and the worsening crisis in the Red Sea are adding to uncertainty and increasing the risk that impacts on international trade going forward.

Given the recent downgrade in the IMF’s outlook for 2024 Eurozone growth from 1.2% to 0.9%, the overall weak state of the economy, and the ongoing slowdown in inflation, opportunities for the European Central Bank (ECB) to relax monetary policy will open. According to the World Economic Outlook report, global growth is projected at 3.1 percent in 2024 and 3.2 percent in 2025. The forecast is, however, below the historical (2000–2019) average of 3.8 percent, with elevated central bank policy rates to fight inflation, a withdrawal of fiscal support amid high debt weighing on economic activity, and low underlying productivity growth. Inflation is falling faster than expected in most regions, amid unwinding supply-side issues and restrictive monetary policy.

In March, the global crude oil prices further strengthened by 4.1% m/m to close the month at $87.00/bbl. This rise can be attributed to the recent Ukraine drone attack on Russian oil refineries, affecting at least 21.0% of the country's supply and compounding the global supply deficit as OPEC+ maintained production cuts.

President Tinubu Opened Land and Air Borders with the Republic of Niger, lifts other sanctions, restored the supply of electricity, and lifted other financial sanctions on humanitarian grounds. We expect the opening of the border to restore commercial and financial activities as coup-held Niger goes through a transition government. Away from that, President Bola Tinubu executed Policy Directives to improve the investment climate and position Nigeria as the preferred investment destination for the oil & gas sector in Africa to remove obstacles to investments in Nigeria, harness the nation’s resources, and diversify the economy for the benefit of all Nigerians.

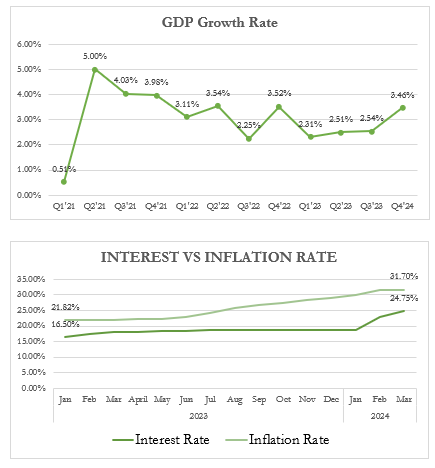

The Central Bank of Nigeria (CBN) fulfilled its promise by announcing the settlement of all valid foreign exchange backlogs totaling $7 billion with the recently disbursed $1.5 billion to meet obligations to bank customers, effectively eliminating the residual balance of the FX backlog to restore credibility and confidence in the Nigerian economy. Elsewhere, the Monetary Policy Committee (MPC) again voted to raise the Monetary Policy Rate (MPR) by 200bps to 24.75% in March. The committee’s decision to hike the MPR further was hinged on (1) the existing inflationary pressures, (2) the need to anchor inflation expectations, and (3) maintaining the stability of the exchange rate. The Central Bank of Nigeria (CBN) announced an increase in the capital base for different categories of banks in Nigeria, the capital base of banks with international authorization has been increased to N500 billion while that of national banks is increased to N200 billion aimed to promote a safe, sound, and stable banking system.

STANDARD and Poor’s (S&P), a global rating agency, has affirmed its ‘B-/B’ long- and short-term foreign and local currency sovereign credit ratings on Nigeria. The agency also affirmed its ‘ngBBB+/ngA-2’ long- and short-term Nigeria national scale ratings. It revised its outlook on Africa’s biggest economy to stable from negative, citing the government’s recent reforms which it believes could benefit the country’s growth and fiscal outcomes if delivered.

Also, global rating agency Fitch Ratings has affirmed that several Nigerian banks have intrinsic strengths to maintain stable business outlook, despite macroeconomic challenges. In its latest ratings report, Fitch stated that Nigeria’s largest banks and many others have sufficient buffers to remain stable in the face of macroeconomic challenges.

Inflation rose to a new record high, increasing by 180bps to 31.70% y/y in February (January: 29.90% y/y) - due to rising food prices and energy costs, floods, and insecurity leading to farmers’ and herders’ clashes.

Nigeria's Gross Domestic Product (GDP) grew by 3.46% (Y-o-Y) in real terms in Q4, 2023. This, when compared to Q3, 2023 which recorded a growth rate of 2.54% represents an increase of 0.92% points and a decrease of 0.06% points when compared with the 3.52% recorded in Q4, 2022.

NIGERIAN CAPITAL MARKET REVIEW

The expectation of rate increases influenced yield directions in the market as we saw sell pressure forced prices to nose-dive and yields increased across the curve in the period under review.

At the March Monthly Bond Auction, the Debt Management Office (DMO) offered a total of N450Bn with total allotments at c. N475.66Bn, across the 19.94% FGN MAR 2027, 18.50% FGN FEB 2031 and 19.00% FGN FEB 2034 papers allotted at marginal rates of 19.94%, 20.00% and 20.45%, respectively.

Likewise, the Central Bank of Nigeria (CBN), on behalf of the FGN, at the last NTB auction for the month offered a total of N1.637Trn across the 91-, 182- and 364-day instruments. Strong demand was witnessed across all tenors. Nonetheless, stop rates on the 91- and 182-day instruments declined by 76bps (16.24%) and 50bps (17.00%) respectively, while the stop rate for 364-day increased by 250bps (21.50%) when compared with the previous stop rate.

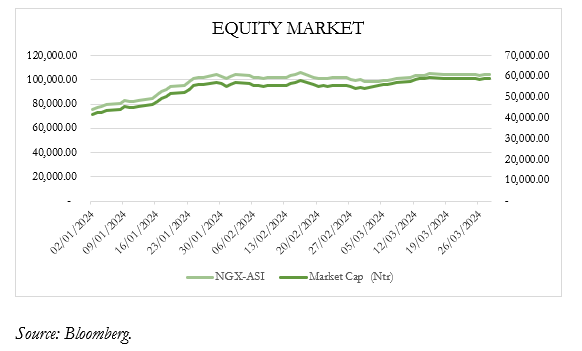

In March, the NGX-ASI closed the month with a 4.60% uptick to print at 104,562.06 points. YTD return printed at 39.80% and market capitalization advanced by 8.10% to ₦59.1tn. Monthly trading activity improved as average volume and value traded rose 9.70% and 88.40% m/m to 595.70m units and ₦16.40bn.

In the same vein, the NGX Pension Board and NGX-30 appreciated to 38.50% and 39.08% as they opened the year at 1,308.54 points and 2,790.28 points to close at 1,812.28 points and 3,880.71 points respectively.

During the month under review, the following stocks declared bonus/dividends: NASCON Allied Industries Plc (2023FY): Bonus 2 for 100, Africa Prudential Plc (2023FY): N0.45k, Lafarge Africa Plc (2023FY): N1.90k, Dangote Cement Plc (2023FY): N30.00k, and BUA Cement Plc (2023FY): N2.00k amongst others.

The chart below shows the trend of the NGX ASI and market capitalization:

In the currency market segment, the Naira strengthened in both the official and parallel market segments following the CBN’s move to clear all verified FX backlogs (final tranche of $1.5bn).

As such, Naira strengthened by 17.91% m/m against the base currency (USD) to exchange at ₦1,309.39/$1.00 at the NAFEM window. In the parallel market segment, the Naira gained 16.40% m/m against the USD to close at ₦1,300.00/$1.00. Similarly, the daily average turnover in the NAFEM segment improved by 8.7% m/m to settle at $857.8m during the period under review.

Nigeria’s foreign reserves printed at $33.89bn on the 27th of March 2024 being the latest update from CBN. Month-on-month, the nation’s reserves increased by over $17.00m compared with a closing balance of $33.72bn in February 2024, supported by inflows from creditors, oil sales, and offshore investors amid ongoing reforms in the FX market.

Find below the key economic indicators for your perusal:

| MAR-23 | JUN-23 | SEP-23 | DEC-23 | MAR-24 | |

|---|---|---|---|---|---|

| Exchange Rate (₦/USD) | |||||

| Official | 460.85 | 770.88 | 775.31 | 907.11 | 1,309.39 |

| Parallel | 748.00 | 765.00 | 1,008.00 | 1,206.00 | 1,300.00 |

| Monetary Policy Rate (MPR) % | 18.00 | 18.50 | 18.75 | 18.75 | 24.75 |

| Inflation Rate | |||||

| 12-Mth Ave (%) | 19.87 | 21.20 | 22.38 | 24.01 | 24.75 |

| Year-on-Year (%) | 21.91 | 22.41 | 25.80 | 28.20 | 31.70 |

| Foreign Reserve (Billion USD) | 35.50 | 34.19 | 33.24 | 32.89 | 33.89 |

| Crude oil Price in the Int’l Market ($/barrel) | 79.57 | 74.90 | 92.42 | 77.64 | 87.00 |

| GDP Growth Rate (%) | 2.31 | 2.51 | 2.54 | 2.54 | 3.46 |

| NGX-ASI | 54,232.34 | 60,968.27 | 66,382.14 | 74,773.77 | 104,562.06 |

| NGX 30 | 1,933.29 | 2,201.23 | 2,442.11 | 2,790.28 | 3,880.71 |

| NGX PENSION BOARD INDEX | 1,000.00 | 1,052.90 | 1,160.90 | 1,308.54 | 1,812.28 |

| Liquidity Ratio (%) | 30.00 | 30.00 | 30.00 | 30.00 | 30.00 |

| Cash Reserve Ratio (%) | 32.50 | 32.50 | 32.50 | 32.50 | 45.00 |

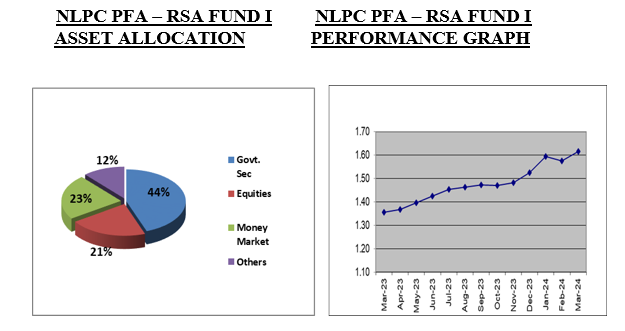

The Asset Allocation and performance of our NLPC PFA – RSA Fund I as at 31st March, 2024 stood as follows:

Quoted Equities 21%, Government Securities 44%, Money Market 23%, Cash & Others 12%. The unit price grew from N1.5256 in January, 2024 to N1.6153 as at 31st March, 2024 translating to a year-to-date positive growth of 5.88% and an annualized return of 23.65%.

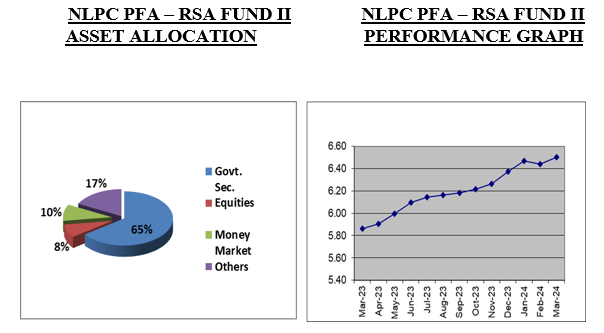

The Asset Allocation and performance of our NLPC PFA – RSA Fund II as at 31st March, 2024 stood as follows:

Quoted Equities 8%, Government Securities 65%, Money Market 10% and Cash & Others 17%. The unit price grew from N6.3730 in January, 2024 to N6.5004 as at 31st March, 2024 translating to a year- to-date positive growth of 2.00% and an annualized return of 8.04%.

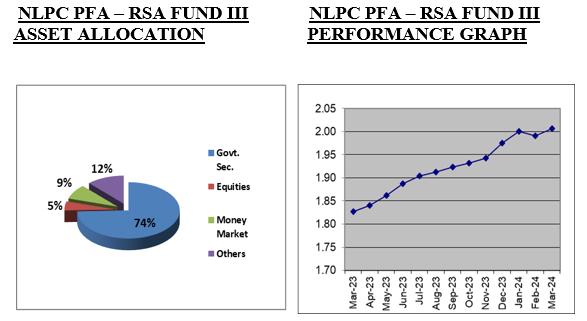

The Asset Allocation and performance of our NLPC PFA – RSA Fund III as at 31st March, 2024 stood as follows:

Quoted Equities 5%, Government Securities 74%, Money Market 9% and Cash & Others 12%. The unit price grew from N1.9751 in January, 2024 to N2.0066 as at 31st March, 2024, translating to a year- to-date positive growth of 1.59% and an annualized return of 6.41%.

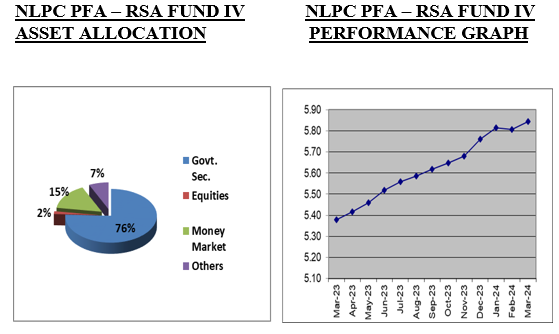

The Asset Allocation and performance of our NLPC PFA – RSA Fund IV as at 31st March, 2024 stood as follows:

Quoted Equities 2%, Government Securities 76%, Money Market 15% and Cash & Others 7%. The unit price grew from N5.7620 in January, 2024 to N5.8447 as at 31st March, 2024 translating to a year- to-date positive growth of 1.44% and an annualized return of 5.77%.

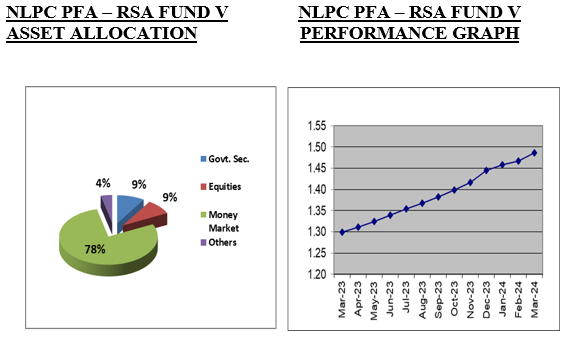

The Asset Allocation and performance of our NLPC PFA – RSA Fund V as at 31st March, 2024 stood as follows:

Quoted Equities 9%, Government Securities 9% Money Market 78%, and Cash & Others 4%. The unit price grew from N1.4452 in January, 2024 to N1.4867 as at 31st March, 2024 translating to a year- to-date positive growth of 2.87% and an annualized return of 11.55%.

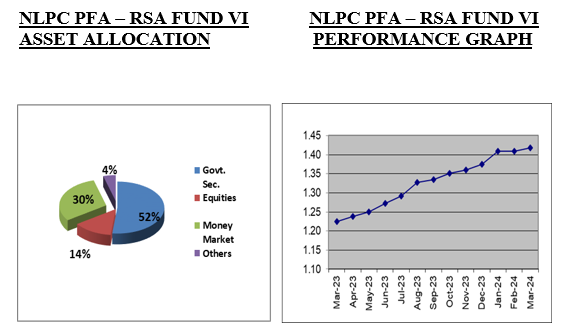

The Asset Allocation and performance of our NLPC PFA – RSA Fund VI - Active as at 31st March, 2024 stood as follows:

Quoted Equities 14%, Government Securities 52%, Money Market 30% and Cash & Others 4%. The unit price grew from N1.3741 in January, 2024 to N1.4186 as at 31st March, 2024 translating to a year- to-date positive growth of 3.24% and an annualized return of 13.03%.

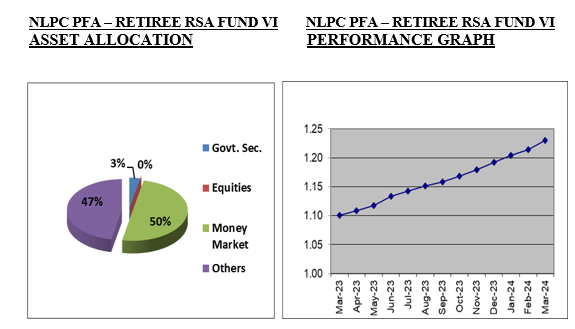

The Asset Allocation and performance of our NLPC PFA – RSA Fund VI - Retiree as at 31st March, 2024 stood as follows:

Quoted Equities 0%, Government Securities 3%, Money Market 50% and Cash & Others 47%. The unit price grew from N1.1922 in January, 2024 to N1.2298 as at 31st March, 2024 translating to year-to-date positive growth of 3.15% and an annualized return of 12.68%.

-

The global economy has been resilient despite higher rates, but strong growth is unlikely in April 2024. This should limit the upside in asset prices, so income from higher yields is likely to be an important driver of returns in the coming period. However, the scenario threatening the global economy continues to be larger-than-expected impact of monetary policy tightening and heightened geopolitical tensions.

-

In the local scene, inflation is expected to remain on the high side, especially with the soaring food prices and the plan of government to increase interest rate in a bid to tame the persistent increase in the general price levels of goods and services. That said, we project that interest rate rates may likely be hiked further in the coming period.

-

We forecast that Nigeria’s real GDP growth will increase modestly to 4.00% in Q2 2024, up from 2.51% in Q2 2023. This will be driven by Dangote refinery that will be selling their products to the local market, and the recent settlement of all valid FX backlogs coupled with the pro-market reforms and policies of the Government.

-

We expect the sentiments across the financial markets to be positive in the new month, most especially in the equities market as more investors will take position in anticipation for impressive full year 2023 results and corporate benefits.

-

Given the elevated yields in the fixed income market space, we expect the buying sentiment to be sustained at the short end of the curve, pending when MPC will commence business friendly expansionary policy, or when there is an improved system liquidity, robust foreign reserve, and surplus balance of payment.

-

Our strategy in the coming period would be to continue to increase our exposure in fixed income securities while ensuring we balance risk and opportunity. Moreover, to take some profits in equities where necessary, whilst also, making provisions for benefit payments across the portfolios under management.

| NLPC PFA-RSA FUND I ASSET ALLOCATION AS AT 31ST MARCH, 2024 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'MLN) | WEIGHT(%) |

| GOVERNMENT SECURITY | 59.53 | 44 |

| MONEY MARKET | 30.75 | 23 |

| EQUITIES | 28.35 | 21 |

| OTHERS | 15.36 | 12 |

| TOTAL | 133.99 | 100 |

| NLPC PFA-RSA FUND II ASSET ALLOCATION AS AT 31ST MARCH, 2024 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'BLN) | WEIGHT(%) |

| GOVERNMENT SECURITY | 95.78 | 65 |

| MONEY MARKET | 14.49 | 10 |

| EQUITIES | 11.59 | 8 |

| OTHERS | 25.61 | 17 |

| TOTAL | 147.47 | 100 |

| NLPC PFA-RSA FUND III ASSET ALLOCATION AS AT 31ST MARCH, 2024 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'BLN) | WEIGHT(%) |

| GOVERNMENT SECURITY | 116.96 | 74 |

| MONEY MARKET | 13.33 | 9 |

| EQUITIES | 8.26 | 5 |

| OTHERS | 18.64 | 12 |

| TOTAL | 157.19 | 100 |

| NLPC PFA-RSA FUND IV ASSET ALLOCATION AS AT 31ST MARCH, 2024 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'BLN) | WEIGHT(%) |

| GOVERNMENT SECURITY | 49.87 | 76 |

| MONEY MARKET | 10.32 | 15 |

| EQUITIES | 1.12 | 2 |

| OTHERS | 4.60 | 7 |

| TOTAL | 65.91 | 100 |

| NLPC PFA-RSA FUND V ASSET ALLOCATION AS AT 31ST MARCH, 2024 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'MLN) | WEIGHT(%) |

| GOVERNMENT SECURITIES | 0.42 | 9 |

| MONEY MARKET | 3.67 | 78 |

| EQUITIES | 0.41 | 9 |

| OTHERS | 0.18 | 4 |

| TOTAL | 4.68 | 100 |

| NLPC PFA-RSA FUND VI - ACTIVE ASSET ALLOCATION AS AT 31ST MARCH, 2024 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'BN) | WEIGHT(%) |

| GOVERNMENT SECURITY | 0.64 | 52 |

| MONEY MARKET | 0.38 | 30 |

| EQUITIES | 0.17 | 14 |

| OTHERS | 0.05 | 4 |

| TOTAL | 1.24 | 100 |

| NLPC PFA-RSA FUND VI - RETIREE ASSET ALLOCATION AS AT 31ST MARCH, 2024 | ||

|---|---|---|

| ASSET CLASS | MARKET VALUE(N'MLN) | WEIGHT(%) |

| GOVERNMENT SECURITIES | 22.79 | 3 |

| MONEY MARKET | 363.28 | 50 |

| EQUITIES | 0.41 | 0 |

| OTHERS | 341.32 | 47 |

| TOTAL | 727.80 | 100 |